Welcome!

Dive into our handpicked selection of informative articles covering a myriad of real estate topics. Our blog is crafted to serve as your ultimate destination for invaluable insights, tips, and trends in the realms of buying, selling, and owning property. Whether you're a seasoned homeowner or embarking on your initial real estate journey, our goal is to furnish you with practical wisdom and inspiration, enabling you to make well-informed decisions.

Keep an eye out for frequent updates that promise to empower you on your journey to successful real estate experiences.

Our Recent Blogs:

Home Shopping by Generation: How Preferences and Trends Differ Across Age Groups

Home Shopping by Generation: How Preferences and Trends Differ Across Age Groups Buying a home is a deeply personal journey influenced by life stages, priorities, and cultural trends. From first-time buyers to retirees, generational differences shape not only what people want in a home but also how they navigate the search process. Let’s dive into how home shopping varies across generations and what these preferences reveal about each group. --- 1. Gen Z (Born 1997-2012): The Emerging Buyers As the youngest generation entering the housing market, Gen Z is just beginning to make its mark as first-time buyers. What They Want:- Affordable options like starter homes or condos. - Proximity to work, public transit, and vibrant social hubs. - Smart home features that cater to their digital-first lifestyles. How They Shop:- Reliance on online listings, apps, and social media to explore properties. - Virtual tours and augmented reality tools for evaluating homes remotely. Challenges They Face: - High home prices and student loan debt make saving for a down payment difficult. --- 2. Millennials (Born 1981-1996): The Market Leaders As the largest group of homebuyers, millennials dominate the market, accounting for over 40% of recent home purchases. What They Want:- Open-concept layouts and energy-efficient designs. - Family-friendly neighborhoods with good schools. - Turnkey homes requiring minimal renovation. How They Shop: - Heavy use of online platforms like Zillow, Redfin, and Realtor.com. - Reviews, market data, and neighborhood insights heavily influence decisions. - Many turn to social media influencers and YouTube for home-buying advice. Challenges They Face: - Balancing affordability with lifestyle-enhancing features, especially in competitive markets. --- 3. Gen X (Born 1965-1980): The Move-Up Buyers Gen X buyers are typically established professionals or parents looking for their forever homes. What They Want:- Larger homes with room for growing families. - Features like home offices, outdoor spaces, and modern kitchens. - Locations near quality schools and amenities like parks and community centers. How They Shop:- A mix of tech-savvy online research and working closely with real estate agents. - Focus on long-term investment value and future appreciation. Challenges They Face: - Balancing the needs of children with those of aging parents, which can influence location and layout choices. --- 4. Baby Boomers (Born 1946-1964): Downsizers and Retirees As they transition into retirement, many baby boomers are looking to downsize or find homes that fit their next chapter. What They Want: - Low-maintenance options like condos or single-story homes. - Proximity to healthcare, leisure activities, and grandchildren. - Energy-efficient and eco-friendly features to reduce costs and environmental impact. How They Shop: - Rely on real estate agents and traditional methods, while using online tools for initial research. - Interested in communities that offer social opportunities, like 55+ neighborhoods. Challenges They Face: - Selling larger homes in slower markets to fund their retirement properties. --- 5. The Silent Generation (Born 1928-1945): The Legacy Seekers Though a smaller group, some in this generation remain active in the housing market. What They Want:- Accessibility features like ramps, wide doorways, and walk-in tubs. - Close proximity to family and healthcare services. - Low-maintenance properties or assisted living communities. How They Shop: - Depend on family members or real estate agents for guidance. - Minimal use of online tools, but open to listings shared by younger relatives. Challenges They Face: - Balancing independence with the need for supportive living arrangements. --- Trends That Unite All Generations While each generation has distinct preferences, some trends resonate across all age groups: Technology: Tools like virtual tours, drone footage, and online listings are transforming how buyers shop for homes. Sustainability: Energy-efficient homes and green features appeal to buyers across generations. Community: Access to schools, workplaces, healthcare, and leisure activities remains a universal priority. --- Final Thoughts Each generation brings unique priorities, challenges, and shopping styles to the real estate market. Understanding these differences can help buyers, sellers, and agents work together effectively. Whether you’re looking for your first home, a family haven, or a retirement retreat, knowing what matters most to you is the key to a successful search. Which generation do you belong to? What are your top priorities when searching for a home? Share your thoughts in the comments below!

Investment Properties: Is Real Estate Still a Smart Move in 2024?

Investment Properties: Is Real Estate Still a Smart Move in 2024? In the dynamic world of finance, real estate has long been a cornerstone for building wealth. From rental properties to commercial spaces, it has historically offered reliable returns, cash flow, and tax advantages. But with rising interest rates, fluctuating home prices, and economic uncertainty, the question arises: Is real estate still a good investment in 2024? Let’s explore the key factors influencing real estate investments this year. 1. Real Estate’s Proven Stability Real estate has consistently been one of the most stable investment options. Unlike the volatility of stocks and cryptocurrencies, real estate tends to appreciate steadily over time. It’s a tangible asset with practical value, offering a hedge against speculative bubbles common in other markets. Even during economic downturns, real estate often rebounds, especially in high-demand areas. The 2008 financial crisis, while severe, was an anomaly caused by systemic issues in lending. Since then, most markets have not only recovered but thrived. 2. Housing Demand Remains Strong Demand for housing continues to drive real estate’s appeal. Growing populations, particularly in urban centers, sustain the need for homes, rentals, and vacation properties. In the U.S., housing inventory shortages in major cities have led to rising prices, creating opportunities for investors, especially those focusing on rental properties. Additionally, platforms like Airbnb have opened new avenues for short-term rental investments, aligning with travel trends and increasing demand. 3. The Rental Market: A Reliable Income Stream Rental properties remain a top choice for real estate investors. Despite higher mortgage rates, rental demand is booming, especially among millennials and Gen Z, many of whom are delaying home purchases due to affordability issues. Well-managed rental properties can provide steady monthly income while tenants pay down the mortgage. In many areas, rents are rising faster than mortgage costs, making rentals a lucrative option. Remote work has further shifted demand toward smaller towns and suburban markets, creating opportunities in previously overlooked areas. 4. Rising Interest Rates: A Challenge, Not a Roadblock Higher interest rates are one of the biggest concerns for real estate investors in 2024. These rates increase borrowing costs and can impact profit margins. However, savvy investors with strong credit, substantial down payments, or cash financing can still find valuable opportunities. Many landlords offset higher mortgage costs by increasing rents, especially in high-demand areas. Adjustable-rate mortgages (ARMs) also provide an option for lower initial payments, which can be advantageous if refinancing becomes an option later. 5. Diversification Through REITs For investors not ready to purchase physical properties, Real Estate Investment Trusts (REITs) offer an attractive alternative. REITs allow you to invest in portfolios of properties—residential, commercial, or industrial—without the responsibilities of direct ownership. They offer dividends, capital appreciation, and the flexibility of trading like stocks, making them a practical choice for diversifying your portfolio. 6. Tax Benefits Sweeten the Deal One of real estate’s biggest draws is its array of tax advantages. Investors can often deduct mortgage interest, property taxes, insurance, and maintenance expenses. Depreciation deductions, even as property values rise, can boost cash flow. Tools like 1031 exchanges, which allow investors to defer capital gains taxes by reinvesting profits into new properties, are another significant advantage, enabling continuous portfolio growth. 7. The Ever-Critical Factor: Location The adage “location, location, location” is more relevant than ever. Cities like Austin, Raleigh, and Salt Lake City, with growing industries and desirable lifestyles, are hot markets in 2024. Remote work has also made suburban and rural areas increasingly attractive, shifting the investment landscape. Early movers in emerging markets often reap the highest rewards. 8. Due Diligence and Long-Term Strategy are Key Real estate success hinges on thorough research and a long-term approach. Evaluate market conditions, neighborhood trends, and financial details of potential properties. Understand local regulations, property taxes, and maintenance costs to ensure profitability. Real estate is not a quick-profit scheme—it requires patience and strategic planning to maximize returns. Conclusion: Is Real Estate Still a Good Investment? Despite rising interest rates and economic uncertainties, real estate remains a compelling investment in 2024. Housing demand, rental income potential, tax advantages, and long-term appreciation make it a resilient asset class. For those willing to research, focus on growing markets, and adopt a long-term strategy, real estate continues to offer opportunities for significant returns and portfolio diversification. Whether you’re buying physical properties or exploring REITs, real estate remains a valuable tool for building and preserving wealth in an evolving market.

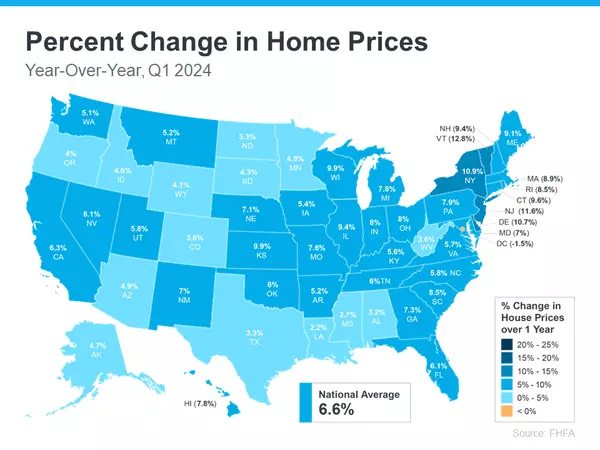

Headlines Are Making You Think Home Prices Are Declining

Headlines Are Making You Think Home Prices Are Declining ... But They're NOT! If you’ve seen the news lately about home sellers slashing prices, you might feel more alarmed than informed. Here’s a clearer picture of what’s really happening with home prices—and yes, it does have to do with who the seller hires to sell their home! While it's true that headlines like “Price Drops Hit Highest Level in 18 Months As High Rates Dampen Buyer Demand” from Redfin might suggest prices are falling, the reality is a bit different. Home prices are actually higher than they were a year ago and are expected to keep rising, albeit at a slower pace. A recent report from Realtor.com indicates that 16.6% of homes on the market had price reductions in May, compared to 12.7% last May. However, this does not mean that overall home prices are falling. Understanding Asking Price vs. Sold Price: The asking price, or listing price, is the amount a seller hopes to get for their home. However, today’s buyers are savvy and cautious, especially with higher mortgage rates straining their budgets. If a home isn't attracting much interest, sellers may need to adjust their asking price, leading to price reductions. If a seller hires someone who simply agrees with them rather than a strategic professional skilled in pricing and marketing, unfortunately they are more likely to experience a longer and more challenging selling process. In contrast, the final sold price is the actual amount a buyer pays when the transaction is complete. It's important to note that actual sold prices are still rising and are expected to continue to do so for at least the next five years. What Does This Mean for Home Prices? The increase in price reductions indicates a moderating demand, prompting sellers to adjust their expectations. Despite these adjustments, home values are still growing annually. According to the Federal Housing Finance Agency (FHFA), home prices increased by 6.6% over the last year. This map illustrates how home prices have risen almost everywhere in the country, indicating that the market is not in decline. While price reductions from sellers might suggest that prices could moderate in the coming months, this is an expected adjustment rather than a cause for alarm. The same article from Redfin also notes: ". . .those metrics suggest sale-price growth could soften in the coming months as persistently high mortgage rates turn off homebuyers. For now, the median-home sale price is up 4.3% year over year to another record high. . ." With inventory as tight as it is today, price moderation is much more likely in the upcoming months than price declines. Why This Is Good News for Buyers and Sellers For Buyers: More realistic asking prices mean a better chance of securing a home at a fair price. It also means entering the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket. For Sellers: Understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and lead to smoother transactions. Bottom Line While the increase in price reductions might seem troubling, it’s not a cause for concern. It reflects a market adjusting to new conditions. Home prices are continuing to grow, just at a more moderate pace. This is why choosing the right agent to help sell your home is crucial. To avoid sitting on the market and facing multiple price reductions, you need an agent who specializes in listing homes and can set realistic expectations based on the current market. This practical approach will help save time and prevent numerous price adjustments. If you've been considering selling your home, let's chat. We can discuss exactly what to expect for your home in today's market! Data Resource: 2024 - Keeping Current Matters

Understanding Commission Rates in Real Estate: Quality vs. Cost

In the quest to save money, many sellers opt for agents offering lower commission rates. While the appeal of immediate savings is understandable, it's vital to weigh the potential drawbacks. Experienced agents with higher commission rates often bring a wealth of knowledge, negotiation skills, and marketing strategies to the table. Their deep understanding of local market dynamics and buyer preferences enables them to position properties effectively and maximize their value. Conversely, agents offering discounted commission rates may lack the experience or resources necessary for effective marketing and negotiation. This could lead to shortcuts in crucial areas like photography and advertising, ultimately reducing a property's appeal and perceived value, resulting in a longer time on the market and potentially lower sale prices. The recent NAR Settlement aims to overhaul commission practices, enhancing transparency in fee negotiations. While it doesn't mandate fee reductions, it ensures buyers have a clearer understanding of costs upfront. For sellers, it's crucial to understand that the settlement doesn't prohibit paying commissions to buyer's agents. Rather, it promotes transparency within the industry, emphasizing the vital role of real estate agents in navigating complex transactions. As for real estate agents, the agreement doesn't impose specific restrictions on fees or services, maintaining the open nature of negotiations. Experienced agents like myself continue to facilitate successful transactions, leveraging expertise in legal intricacies, market trends, and negotiation techniques to ensure optimal outcomes for clients. Despite these changes, this year's spring selling season remains robust. If you're considering selling your home, now is an excellent time to capitalize on market opportunities. Reach out today to discuss the NAR settlement and your plans for selling your home this year.

The Ultimate Relocation Guide: From Finding a House to Feeling at Home

The peak moving season is upon us, with almost 70% of U.S. moves happening between May and September according to Move.com. Despite a decline in the annual percentage of movers, the desire to relocate remains strong, with 55% of adults expressing a desire to move in 2024, as found by Architectural Digest. If you're among those eager for a change, this guide is designed for you. While moving can seem daunting and stressful, we've outlined six steps to streamline the process, allowing you to focus on the adventure ahead. 1. Choose a Community: Finding the right neighborhood involves considering various factors like proximity to work, safety, and affordability. We're here to offer recommendations tailored to your needs. 2. Find Your New Home: Whether renting or buying, we'll guide you through the process, emphasizing the benefits of homeownership and the stability it offers. 3. Sell or Rent Out Your Current Home: We'll help you evaluate your options based on current market conditions and address common concerns like timing and financial implications. 4. Plan Your Departure: From sharing news with your family to scheduling goodbye gatherings, we'll assist you in preparing for your move with practical tips and support. 5. Prepare for Your Arrival: Planning ahead for utilities, cleaning, and essentials ensures a smooth transition into your new home. We're here to provide guidance and recommendations to make settling in easier. 6.Get Settled in Your New Space: Combat feelings of loneliness and stress by prioritizing unpacking, supporting your pets' adjustment, and engaging with your new community. Let's Get Moving: With our expertise and network of professionals, we aim to make your relocation as seamless as possible. Contact us for a free consultation and let's embark on this journey together! [Sources: Moving.com, Architectural Digest, National Association of Realtors, Statista, Psychology Today] Disclaimer: The above is for informational purposes only and not intended as financial, legal, or tax advice. Consult relevant professionals for personalized guidance.

Downsize Your Home, Rightsize Your Life

Downsize Your Home, Rightsize Your Life: How to Choose the Ideal Smaller Home When you've lived somewhere for many years, it can be tough to say goodbye. But if you (or a loved one) currently have a home that is bigger than necessary or is too high maintenance, it may be time to trade unused square footage for a smaller, more manageable space. Take it from the downsizers who’ve been there: Although living small might require some adjustments, it can also be liberating––especially if you're in a stage of life where past responsibilities have given way to new possibilities and adventures. In fact, many downsizers report feeling invigorated by the change, according to real estate journalist and author Sheri Koones. “It scares people to think of moving into a smaller space,” said Koones to the Associated Press. “But every single person I interviewed who has made the transition says they are so happy they did.”1 The key is to find somewhere you can live well and move around comfortably, without feeling overly restricted. If you like the idea of aging in place or are already in your golden years, you may also want to look for signs that a new home can conveniently age with you. With that in mind, we recommend focusing your search around three key factors: desired lifestyle, optimal design, and long-term accessibility. Read on for specific tips, then call us for a free consultation. We can help you identify the types of homes that are best suited to living large with less. Do you have a loved one whose housing needs have changed? Share this information to help start a conversation about the benefits of downsizing. DESIRED LIFESTYLE The best part of downsizing is the lifestyle you unlock when you trade square footage for convenience. With fewer chores and home maintenance tasks to worry about, you can instead channel your energy into other pursuits. For example, instead of spending your afternoons working in the yard or cleaning, you can catch up on the news, read a bestseller, start a new craft project, or pursue other hobbies. You may even be able to travel or spend more time with friends and family. Research shows that individuals over the age of 65 report more life satisfaction when they have the opportunity to spend time around children, talk with friends, socialize in community centers, volunteer, or engage in hobbies. But that can be hard to do regularly when you've got a home that needs constant attention or you live far from your community.2 As you compare potential homes, keep in mind the type of lifestyle you envision. Do you plan to travel? If so, a home with extra security, such as a condominium or gated community, may give you some welcome peace of mind. Or do you plan to have friends and family stay overnight? In that case, you may want to look for a floor plan with flex space or a property that has access to separate guest suites. Alternatively, a senior community that offers catered meals and housekeeping may be a better choice if you or a spouse need extra support. Action item: Grab a pen and take some time to envision what your ideal future might look like. Write down the activities and hobbies you hope to add to your life or continue with going forward, as well as the chores and responsibilities you'd love to drop. We can use those answers to help shape your house hunt. OPTIMAL DESIGN Even though your new home will be smaller, that doesn't mean it has to feel cramped. As Koones explains, “The key is to have a home that is efficiently designed, both in terms of energy use and in terms of space.”1 Look for features that can help make a space feel bigger, like high ceilings, large windows, and an open layout. Built-in shelving that extends all the way to the ceiling can also make a small room feel more expansive by helping to draw the eye upward. The same goes for highly placed window treatments and striped or mural-style wallpaper, says interior designer, Kati Greene Curtis. “You’ll feel like you’re walking into the scene,” said Curtis to the Washington Post.3 Efficient layouts with flexible, multi-purpose rooms and few, if any, hallways work especially well for small-scale living. You can also limit dead space in a home by steering clear of layouts with awkward corners, unusable nooks, and other space-eating design elements. In addition, look for features that support a simpler, lower-maintenance lifestyle, such as easy-care floors, durable countertops, and bare walls with little, if any, crown molding. Don’t write off a home too soon, though, if it feels narrow or congested because of outdated design or poor staging. Cosmetic issues that visually shrink a space are often easy to fix. For example, you can instantly make a room feel bigger just by painting it a lighter shade. Adding mirrors and swapping out heavy curtains for sheer ones can also be effective. Plus, utilizing multipurpose furniture with hidden storage is a great way to maximize space. Action item: Make a note of your must-keep furniture and other items. Then pull out a measuring tape and write down the dimensions. Once it's time to visit homes, we'll have a more accurate sense of what will fit and how much space you’ll need. To get your creative juices flowing, you may also want to flip through some design magazines that specialize in compact living or catalogs that feature space-saving furniture and accessories. If you give us a list of your favorite features, we can use it to pinpoint homes that are a good match. LONG-TERM ACCESSIBILITY Buying a home that you can age well in can be a great way to boost your health prospects and happiness. According to the U.S. Department of Housing and Urban Development (HUD), homeowners who age in place instead of in an institutional environment not only save money over time, they also enjoy greater health and emotional benefits.4 Aging in place is also popular. According to survey findings from the National Poll on Healthy Aging, the vast majority of adults between the ages of 50 and 80 would prefer to age in their own homes.5 But even though many adults want to age in place, only 34% of surveyed adults currently live in a home with the features to make it possible.5 If you're already in the second half of your life, then it's smart to prioritize accessibility now, even if you're highly mobile. Choosing an accessible home will improve your odds of staying put for longer. Plus, you never know when you might need an accessible light switch, handrails in the bathroom, or a seat in the shower, says Sheri Koones. “Yes, older people with disabilities need them, but even younger people break a leg skiing, or have situations where they want a barrier-free shower.”1 As you consider your options, try to imagine what your needs might be as you get older and be proactive in identifying potential obstacles, recommends the National Council on Aging (NCOA).6 For example, a single-level home or one with wide enough stairs for a stair lift or access to an elevator may be a more practical choice than a home with lots of narrow stairs. Alternatively, a home with at least one ground-level bedroom and bathroom may also work well for you. Consider your needs outside the home, as well: If you frequently visit the doctor, grocery store, or community center, for example, then you may benefit from choosing a property nearby. Action item: Review the checklist below, adapted from the National Institute on Aging’s home safety worksheet, or download the full version from the agency’s website.7 Highlight the items that are most important to you. We can reference these guidelines as we consider potential homes and suggest ways to adapt a property to meet your current or future requirements. HOME SAFETY CHECKLIST 7 If a walker or wheelchair is needed, can the entrances to the house be modified — perhaps by putting in a ramp to the front door? Are there any tripping hazards at exterior entrances or inside the house? Are the hallways and doorways wide enough to accommodate a wheelchair if needed? Does the home have at least one ground-floor bedroom and bathroom? Are there any staircases, and if so, could they accommodate a stair lift? Is the house well-lit, inside and out, particularly at the top and bottom of stairs? Could handrails be installed on both sides of the staircase? Is there at least one stairway handrail that extends beyond the first and last steps on each flight of stairs? Are outdoor steps sturdy and textured to prevent falls in wet or icy weather? Are there grab bars near toilets and in the tub or shower? Have a shower stool and hand-held shower head been installed to make bathing easier? Is the water heater set at 120° F to avoid scalding tap water? Are there safety knobs and an automatic shut-off switch on the stove? Have smoke and carbon monoxide alarms been installed near the kitchen and in all bedrooms? Are there secure locks on all outside doors and windows? BOTTOMLINE You don't have to compromise on comfort to downsize successfully. We can help you strategize your next move and identify the best new home for you—whether that's a smaller home for rent or another one to call your own. We take pride in offering a full-service real estate experience and assisting our clients through all stages of the real estate journey. And we’ll go the extra mile to maximize your current home's sales price so that you’re set up for financial security. The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: Associated Press (AP) - https://apnews.com/article/lifestyle-f094372b46bae82020c174907eb953c0 Healthcare (Basel) - https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10671417/ Washington Post - https://www.washingtonpost.com/home/2023/02/07/make-small-room-appear-larger/ HUD User - https://www.huduser.gov/portal/periodicals/em/fall13/highlight2.html National Poll on Healthy Aging - https://www.healthyagingpoll.org/reports-more/report/older-adults-preparedness-age-place National Council on Aging (NCOA) - https://www.ncoa.org/adviser/medical-alert-systems/downsizing-for-aging-in-place/ National Institute of Health (NIH) - https://www.nia.nih.gov/sites/default/files/2023-04/worksheet-home-safety-checklist_1.pdf

6 Strategies to Save on Home Insurance Premiums

From wildfires to floods, the past few years have brought a historic number of devastating climate and weather events to the United States. In 2023 alone, there were 28 individual weather-related disasters that caused at least $1 billion in damages each.1 These events triggered a huge influx of home insurance claims, and analysts expect the increase in both catastrophes and claims to continue. Adding to the problem, construction labor and supply costs have risen, making it more expensive to repair affected homes. Consequently, home insurance rates have surged: In 2024, Bankrate reports, premiums are already up an average of 23%, following double-digit increases the previous year.2,3 In disaster-prone regions, the situation is even more challenging. Some insurers have pulled out of risky areas entirely, and many of those that still offer policies in high-risk areas have doubled or even tripled their premiums.4 For most homeowners, comprehensive home insurance coverage is crucial for financial security—but massive rate increases can turn a once-affordable home into a financial burden. They can also pose a serious challenge for sellers. A home insurance policy is typically required to get a mortgage, and, in some hard-hit regions, we’re seeing sales fall through or homes sit on the market because insurance policies are unattainable or too expensive.5,6 But don’t panic! While these broader trends may be out of your control, there’s still plenty you can do to save. Here are our top six strategies to slash insurance premiums while maintaining the protection you need. 1. SHOP AROUND Getting multiple quotes is a smart move for many major purchases, including home insurance. We recommend reviewing at least three estimates before you commit to a policy. You can get quotes either by reaching out to insurers directly or by working with an independent insurance broker.7 You’ll need to provide detailed information about the property you’re insuring and your claims history. Make sure you read policies carefully before you choose. Sometimes, a policy can look like a better deal at first glance but turn out to have important coverage gaps. Be sure to consider how much the policy will pay out to repair or replace your home and review caps on personal possession and liability claims. It’s also smart to read reviews from policyholders (Trustpilot is a good place to start) and ratings published by organizations like the Better Business Bureau and J.D. Power. For help choosing the right policy, reach out to us for a list of trusted insurance professionals. 2. INCREASE YOUR DEDUCTIBLE The size of your deductible—which is the amount you pay before your insurance coverage kicks in on a claim—is a major factor in your insurance cost. A low deductible, such as $500, comes with higher premiums, while a higher deductible, like $2,500 or even $5,000, costs less on a monthly basis. In some cases, you may be able to customize your coverage further by designating a different deductible for certain kinds of claims, such as those caused by named storms or natural disasters. If you are confident that you have enough in savings to cover that initial outlay if needed, choosing a higher deductible can help you save significantly over the long term. According to Nerdwallet, raising your deductible from $1,000 to $2,500, for example, could save you an average of 11% each year.8 3. BUNDLE MULTIPLE TYPES OF INSURANCE Insurers want to get as much of your business as possible, so most offer significant discounts if you bundle your home and auto insurance, meaning that you package the two policies together. With some insurers, you can get even higher savings by bundling more than home and auto—RV, boat, jewelry, and life insurance are potential options to consider. According to US News and World Report, insurers typically offer customers who bundle home and auto insurance 10-25% savings on monthly premiums. This approach also has other advantages: It cuts down on your paperwork, and in some cases—like if a storm damages both your home and car—you may be able to pay just one deductible instead of two when you file a claim.9 However, before you sign on the dotted line, remember strategy #1 and be sure to shop around. In some cases, bundling isn’t the cheaper option, and bundling deals vary between companies. It’s also critical to carefully check that the bundled coverage offers everything you need. 4. ASK ABOUT AVAILABLE DISCOUNTS Did you know that being a nonsmoker might qualify you for a home insurance discount?8Some insurers offer some surprising incentives for policyholders who pose a statistically lower risk of filing a claim. In the case of nonsmokers, that’s because of the decreased risk of a home fire. Many carriers also offer discounts to military-affiliated families, homeowners in certain professions, such as teachers or engineers, or recent homebuyers. Sometimes, you can also save by opting for paperless billing or paying your premiums for a full year upfront.10 Since available discounts vary significantly between insurers, the best strategy is to simply ask a representative for the full list of available discounts so you can see what cost savings might be available to you. 5. AVOID MAKING SMALL CLAIMS Worried that your premiums will rise significantly in the future? Try to avoid making a claim unless truly necessary. Many insurers offer discounted rates to policyholders who go a certain number of years without filing a claim, and filing multiple claims typically results in large increases.10 If you file too many, you may even risk nonrenewal of your policy.11 Since the cost of even a small premium increase can add up significantly over time, if you have minor damage to your home—for example, if a few shingles blew off your roof in a windstorm—it may be a wiser long-term financial decision to pay out of pocket instead of filing a claim. If the cost of the repair is less than your deductible, it never makes sense to file, and if it’s just slightly above your deductible, it’s also usually best to pay for the repairs yourself. Additionally, always be sure to review your policy before you make a claim. Even claims that are denied can count against you, so it’s not worth filing if the damage is clearly excluded from coverage.11 If you find yourself in this situation, feel free to reach out for a list of reasonably-priced professionals who can help with home repairs. 6. BE STRATEGIC ABOUT HOME IMPROVEMENTS Insurance premiums alone may not be the deciding factor for a home improvement project, but it’s important to know how renovations could impact your rates—for better or worse. For example, some upgrades and repairs can reduce your premiums by making your home safer or less prone to certain types of damage. These include:12 Upgrading your electrical system Updating your plumbing Installing a monitored security system Adding a fire sprinkler system Replacing the roof On the other hand, some upgrades can raise premiums significantly, either because they increase the value of your home (and therefore the cost to replace it) or because they pose a hazard. These include:12 Installing a swimming pool or other water features Building an extension or expanding your living space Upgrading materials, like flooring or countertops Adding a fireplace or woodstove Whether or not your planned renovations are on either of these lists, it’s wise to inform your insurer about changes you make to your home—otherwise, you may risk gaps in coverage. And you’re always welcome to check with us before you begin any home improvement project to find out how it could impact the value and resale potential of your home. BOTTOMLINE: Protect Your Investment Without Sacrificing Enjoyment of Your Home Getting the coverage you need for financial security without overpaying can be a tricky balance, especially in today’s environment. But remember, while it’s important to find the best deal you can, home insurance isn’t an area to skimp on. For advice on your specific risks and the type of coverage you need, we recommend consulting with a knowledgeable insurance professional. We’re happy to connect you with a trusted adviser in our network. And if you’re considering a home renovation, feel free to reach out for a free consultation on how it might affect your property value (and your premiums). The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, insurance, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: Climate.gov - https://www.climate.gov/news-features/blogs/beyond-data/2023-historic-year-us-billion-dollar-weather-and-climate-disasters Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/homeowners-insurance-cost/ Policygenius - https://www.policygenius.com/homeowners-insurance/home-insurance-pricing-report-2023/ CNN - https://www.cnn.com/2023/09/20/business/insurance-price-increase-risk-climate-first-street-dg/index.html BBC - https://www.bbc.com/news/business-66367224 US News - https://realestate.usnews.com/real-estate/articles/how-climate-change-could-impact-your-home-value Nerdwallet - https://www.nerdwallet.com/article/insurance/how-to-shop-for-homeowners-insurance Nerdwallet - https://www.nerdwallet.com/article/insurance/save-on-homeowners-insurance US News and World Report - https://www.usnews.com/insurance/homeowners-insurance/how-to-bundle-home-and-auto-insurance Marketwatch - https://www.marketwatch.com/guides/insurance-services/how-to-save-on-homeowners-insurance/ Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/when-to-file-a-home-insurance-claim/#when Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/home-insurance-and-renovations/

Need A Realtor? Here Are Some Things You Should Ask...

As a continuation of our previous blog, we're providing a helpful outline of questions for you to ask agents during your interviews. Feel free to select the questions that resonate most with you and incorporate them into your interview process! Seller Interview Questionnaire for Selecting a Realtor 1. Experience and Expertise: a. How many years have you been working as a real estate agent? b. Can you provide examples of homes similar to mine that you've successfully sold in the past year? c. What neighborhoods or areas do you specialize in? 2. Marketing Strategy: a. What is your approach to marketing homes? b. How do you plan to showcase my property to attract potential buyers? c. Do you use professional photography, staging, or virtual tours to enhance listings? 3. Pricing and Market Analysis: a. How do you determine the value of a property? b. Can you provide a comparative market analysis (CMA) for my home? c. What is your strategy for pricing my home competitively in the current market? 4. Communication and Availability: a. How often will you provide updates on the status of my listing? b. What methods of communication do you prefer? (e.g., phone, email, text) c. How accessible are you for questions or concerns throughout the selling process? 5. Negotiation Skills: a. How do you approach negotiations with buyers and their agents? b. Can you provide examples of successful negotiations you've conducted on behalf of sellers? c. What is your strategy for achieving the best possible price for my home? 6. References and Testimonials: a. Can you provide references from past clients? b. Do you have any testimonials or reviews that I can review? c. How do you ensure client satisfaction throughout the selling process? 7. Additional Services: a. Do you offer any additional services or resources to assist sellers? (e.g., relocation assistance, home staging) b. Are there any specific marketing tools or platforms that you utilize to promote listings? c. How do you handle any potential challenges or obstacles that may arise during the selling process? 8. Commission and Fees: a. What is your commission rate and what services does it cover? b. Are there any additional fees or costs associated with selling my home? c. Can you provide a breakdown of all expected expenses involved in the selling process? 9. Contracts and Agreements: a. Can you walk me through the terms of the listing agreement? b. What is the duration of the listing agreement, and what happens if I'm not satisfied with your services? c. Are there any clauses or conditions in the agreement that I should be aware of? 10. Personal Compatibility: a. What sets you apart from other real estate agents? b. How do you ensure a positive and productive working relationship with your clients? c. Why should I choose you as my Realtor to sell my home? Remember, it's essential to feel comfortable and confident with the Realtor you choose to represent you in the sale of your home. Asking these questions will help you make an informed decision and select the best agent for your specific needs and preferences. -- Buyer Interview Questionnaire for Selecting a Realtor 1. Experience and Expertise: a. How many years have you been working as a real estate agent? b. Can you provide examples of homes similar to what I'm looking for that you've helped buyers purchase recently? c. What neighborhoods or areas do you specialize in? 2. Understanding of Buyer Needs: a. How do you determine the needs and preferences of your buyers? b. Are you familiar with the specific features and amenities I'm looking for in a home? c. How do you tailor your search to match my criteria and preferences? 3. Market Knowledge: a. How well do you know the local real estate market? b. Can you provide insights into current market trends, including pricing, inventory, and competition? c. What neighborhoods or areas do you recommend based on my preferences and budget? 4. Access to Listings and Properties: a. How do you source and access listings that match my criteria? b. Do you have access to off-market properties or exclusive listings? c. How do you ensure that I'm among the first to know about new listings that meet my requirements? 5. Communication and Availability: a. How often will you update me on new listings and market developments? b. What methods of communication do you prefer? (e.g., phone, email, text) c. How accessible are you for questions or showings, including evenings and weekends? 6. Negotiation Skills: a. How do you approach negotiations on behalf of buyers? b. Can you provide examples of successful negotiations you've conducted for your clients? c. What is your strategy for securing the best possible price and terms for the properties I'm interested in? 7. Financing and Referrals: a. Do you have preferred lenders or mortgage brokers that you can recommend? b. How do you assist buyers with financing options and pre-approval? c. Are there any additional resources or professionals you can refer me to during the homebuying process? 8. Legal and Contract Expertise: a. Can you explain the homebuying process and the various contracts and agreements involved? b. How do you ensure that my interests are protected throughout the transaction? c. Are there any potential legal or contractual issues that I should be aware of as a buyer? 9. Buyer Representation: a. What services do you provide to buyers beyond finding listings? (e.g., market analysis, property inspections) b. How do you guide buyers through the offer and negotiation process? c. Do you provide assistance with due diligence and closing procedures? 10. Personal Compatibility: a. What sets you apart from other real estate agents? b. How do you ensure a positive and productive working relationship with your buyers? c. Why should I choose you as my Realtor to help me find and purchase my next home? As a buyer, it's essential to feel confident and comfortable with the Realtor you choose to represent you in your homebuying journey. Asking these questions will help you assess their qualifications, expertise, and compatibility with your needs and preferences, ultimately leading to a successful and satisfying home purchase experience. We genuinely hope you find this helpful! If you need more advice or have any questions, please don't hesitate to reach out. We're here for you and always happy to assist!

Navigating the Sea of Real Estate Agents: How to Choose the Right Partner for Your Journey

In today's vibrant real estate market, the sheer number of agents available can understandably leave buyers and sellers feeling overwhelmed when it comes to selecting the right professional to entrust with their significant investments. If you find yourself without a trusted recommendation or a friend to turn to (like myself), I'd recommend interviewing several agents. Take the opportunity to discern what distinguishes each one and identify the agent with whom you resonate most. While we all appreciate the importance of saving money, it's crucial to recognize that selecting the wrong agent could potentially incur unexpected costs. Therefore, it's essential to invest time in thoroughly assessing and distinguishing between the services offered by different agents. In this blog, we'll delve into the intricacies of navigating the diverse landscape of real estate agents and provide valuable insights on selecting the ideal partner for your unique real estate journey. 1. Research and Credentials Matter: Before diving into the pool of real estate agents, take the time to research their credentials, experience, and track record. Look for agents who are licensed, knowledgeable about the local market, and have a proven record of success. Online reviews, testimonials, and referrals from friends or family can also provide valuable insights into an agent's reputation and professionalism. Find my reviews HERE! 2. Seek Compatibility and Communication: Effective communication and a strong rapport are essential components of a successful agent-client relationship. When interviewing potential agents, pay attention to their communication style, responsiveness, and ability to listen to your needs and preferences. Choose an agent who makes you feel comfortable, valued, and understood, as this will ensure a smoother and more enjoyable experience throughout the buying or selling process. 3. Specialization and Expertise: Consider the specific needs of your transaction and look for agents who specialize in your desired area or property type. Whether you're buying a luxury home, selling a condominium, or investing in commercial real estate, working with an agent who has expertise in your niche can provide valuable insights and guidance tailored to your unique situation. Check Out My Resume HERE! 4. Evaluate Marketing Strategies: A successful real estate transaction often hinges on effective marketing strategies that maximize exposure and attract qualified buyers or sellers. Inquire about the agent's marketing plan, including their approach to listing presentations, online presence, photography, staging, and advertising efforts. Choose an agent who demonstrates creativity, innovation, and a comprehensive marketing strategy to ensure your property stands out in the competitive market. 5. Trust Your Instincts: Ultimately, trust your instincts when choosing a real estate agent. Pay attention to your gut feeling and intuition during the initial consultation and interactions with potential agents. Look for someone who is transparent, honest, and genuinely invested in your success, rather than solely focused on closing the deal. Trust is the foundation of any successful partnership, so choose an agent whom you feel confident entrusting with your real estate goals. While the abundance of real estate agents may seem daunting at first, taking the time to research, evaluate, and connect with potential partners can lead you to the perfect match for your needs. By considering factors such as credentials, communication, specialization, marketing strategies, and personal compatibility, you can confidently choose an agent who will guide you through every step of your real estate journey with professionalism, expertise, and integrity. Happy house hunting! Looking for a Realtor in Colorado? Let's set up a time to connect! I'm eager to explore whether we're a perfect match for your needs. Seeking a recommendation for an outstanding agent outside of Colorado? Don't hesitate to reach out—I have a network of trusted agents nationwide!

The Pitfalls of Hiring a Discount Real Estate Agent: Why Investing in a Professional Is Worth It

In the competitive world of real estate, sellers and buyers often seek ways to save money, leading them to consider hiring discount agents. While the allure of lower fees may seem appealing at first glance, it's essential to understand the potential drawbacks of opting for a discount agent over a seasoned real estate professional. In this blog, we'll explore the reasons why choosing a discount agent may not be the best decision and why investing in a qualified real estate professional offers invaluable benefits and peace of mind. Limited Experience and Expertise: Discount agents may lack the experience and expertise necessary to navigate the complexities of the real estate market effectively. Real estate transactions involve intricate processes, legalities, and negotiations that require a thorough understanding and knowledge of the industry. By hiring a discount agent, you risk working with someone who may not have the skills or experience to represent your best interests adequately. Reduced Marketing and Exposure: One of the key responsibilities of a real estate agent is to market your property effectively to attract potential buyers or find the perfect home for you. Discount agents may cut corners when it comes to marketing efforts, such as professional photography, staging, or targeted advertising campaigns. As a result, your property may receive limited exposure in the market, ultimately affecting its visibility and potential for a successful sale or purchase. Lack of Personalized Service: Real estate transactions are inherently personal and often involve significant financial decisions. Discount agents may prioritize quantity over quality, juggling multiple clients simultaneously and providing minimal attention to each transaction. As a result, you may not receive the personalized service and support you need throughout the buying or selling process, leading to frustration and dissatisfaction. Limited Resources and Networking: Established real estate professionals have access to a vast network of industry contacts, including other agents, lenders, inspectors, and contractors. This network can be invaluable when navigating various aspects of a real estate transaction, such as securing financing, scheduling inspections, or negotiating repairs. Discount agents may lack these connections, potentially hindering the smooth progression of your transaction. Risk of Legal and Financial Pitfalls: Real estate transactions involve significant legal and financial implications, and any missteps can have serious consequences. Discount agents may not possess the legal knowledge or attention to detail required to identify and address potential risks effectively. By working with a qualified real estate professional, you benefit from their expertise in navigating complex contracts, disclosures, and potential liabilities, reducing the risk of costly mistakes. While the prospect of saving money with a discount agent may be tempting, it's essential to consider the potential drawbacks and risks involved. Investing in a reputable and experienced real estate professional offers numerous advantages, including expertise, personalized service, marketing prowess, and access to valuable resources and networks. When it comes to buying or selling your most significant asset, it's worth prioritizing quality and peace of mind over short-term cost savings. **I understand that every property and seller is unique, which is why I offer customizable package options tailored to your specific needs. These packages include a range of services at varying commission percentages, ensuring flexibility and transparency throughout the process. Moreover, I empower sellers by allowing them to set the commissions they will pay the buyer's agent. While I provide guidance and support in this decision-making process, giving sellers control over their commissions instills confidence and peace of mind. By selecting the package that aligns best with your preferences and property, you gain clarity and assurance about the services you're receiving. It's all about empowering you to make informed decisions and feel confident about your investment! Schedule a time to chat and we can discuss this further!

STOP! Read This Before You Check Out That Model Home!

In the world of real estate, buying a new build home can be an exciting but intricate process. Amidst the allure of modern amenities and customizable features, buyers may encounter what seems like irresistible incentives offered directly by builders. However, beneath the surface, these incentives may not be as advantageous as they appear. In fact, some builders employ cunning tactics to bypass realtors, ultimately pocketing more profit for themselves and leaving the purchaser without representation. Let's delve into the hidden truth behind these so-called "incentives" and how buyers can protect themselves: 1. Direct Sales Strategies: Builders often use direct sales tactics to entice buyers into purchasing directly from them. In fact, they do so in a way that most consumers don’t realize. They may offer incentives such as free upgrades, closing cost assistance, or appliance packages, creating the illusion of a great deal. However, these incentives may not always equate to genuine savings, and buyers risk overpaying without the guidance of a realtor to scrutinize the offer. 2. Lack of Transparency: Builders may not fully disclose the details of their incentives or present them in a misleading manner. For instance, they might advertise a "special promotion" with free upgrades, neglecting to mention that these upgrades are already included in the base price of the home. Without a realtor to decipher the fine print, buyers may unwittingly fall prey to deceptive marketing tactics. 3. Exclusion of Realtor Representation: Builders often encourage buyers to bypass their own realtor and purchase directly from them to avoid commission fees. By offering enticing incentives like free upgrades, builders persuade buyers to forego realtor representation, increasing their profits while depriving buyers of essential guidance. Although builders typically cover the buyer's agent's cost, they often present this as a cost-saving opportunity to the buyer, creating the illusion of savings. In reality, buyers risk missing out on vital support and may face pressure to accept unfavorable terms. Furthermore, some builders require the use of their "preferred agents" for listing existing homes, granting them excessive control over transactions and leaving buyers without advocates for their interests and likely finding themselves pressured to accept terms that may not be in their best interests. 4. Limited Negotiation Power: Buyers who purchase directly from builders may lack the negotiation leverage that realtors bring to the table. Realtors are skilled negotiators adept at securing favorable terms, additional incentives, or price reductions on behalf of their clients. Without realtor representation, buyers may miss out on opportunities to maximize their investment and save money. So, while builders may offer enticing incentives to entice buyers, it's essential for buyers to exercise caution and seek realtor representation. By enlisting the services of a qualified realtor, buyers can navigate the complexities of the new build process and ensure they are making informed decisions. Realtors provide invaluable guidance, advocacy, and negotiation skills, safeguarding buyers' interests and helping them achieve the best possible outcome. So, before succumbing to the allure of builder incentives, buyers should consider the benefits of having a realtor by their side. Takeaway: Immediately disclose your realtor affiliation (1st visit!) when visiting new build sites, even if you're just browsing. Hidden clauses in builder agreements may leave you responsible for realtor fees if you don't disclose your agent on the first visit. As my client, provide builders with my contact info to avoid any confusion on their part. Would you risk navigating legal proceedings without the expertise of the best attorney to represent your innocence? Or would you trust the prosecution when they claim to help you? Just as you wouldn't gamble with your legal defense, don't take chances when it comes to your real estate journey. Partnering with a skilled realtor ensures you have a dedicated advocate working tirelessly to protect your interests and secure the best possible outcome for you.

Exploring Denver Metro Area's Latest Inflation Trends: What You Need to Know

According to the latest data released by the U.S. Bureau of Labor Statistics on Tuesday, the inflation rate in the Denver metro area stands at 3.5% over the past year. While this figure is lower than the 4.5% rate reported for the previous period, it remains slightly above the national average of 3.1% from January 2023 to January 2024. Recent fluctuations in prices within the metro area show a slight decrease of 0.1% since November, as indicated by the Consumer Price Index. Analysts from the Common Sense Institute attribute this decrease to declines in energy and transportation costs, marking consecutive bi-monthly periods of deflation since September to November 2023. Denver ranks ninth out of 23 metro areas tracked by the CPI in terms of total price growth since 2020, highlighting the region's economic dynamics. On a national scale, prices rose by 0.3% in January, primarily driven by housing increases. The shelter index recorded a 0.6% increase, contributing significantly to the overall rise in consumer prices. However, energy prices experienced a decline of 0.9% for the month, largely due to the decrease in gasoline prices. Despite the recent downturn, the average household in Colorado faced increased expenses, averaging $1,194 a month in December and January. The recent decline in consumer inflation in metro Denver can be attributed to decreases in transportation costs, with gasoline prices dropping by 16% over the past two months and used car and truck prices declining by 3.8%. While clothing prices also saw a reduction of 6.6% over the past year and 1.5% in the past two months, housing costs remain a significant driver of inflation, with rents increasing by 5.7% year-over-year and equivalent rent for homeowners rising by 7.2%. Rising household energy costs continue to impact Colorado consumers, with prices up by 9.7% over the past year. Food prices witnessed varied trends, with prices for foods purchased for home consumption increasing by 1.5% since November but decreasing for certain items over the past year. However, consumers dining out experienced continued price hikes, with the index for food eaten away from home up by 6.7% over the past year. In summary, while recent trends indicate a slight moderation in inflation rates, various factors continue to influence consumer prices in the Denver metro area. Understanding these dynamics is essential for navigating economic trends and making informed financial decisions.

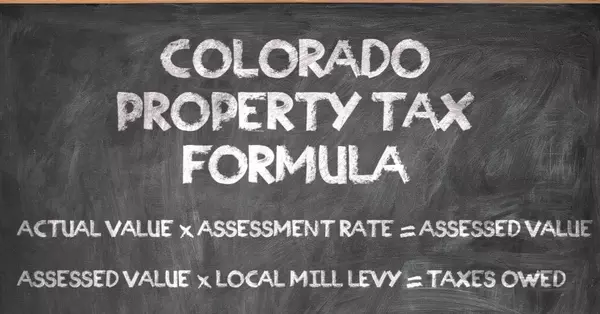

How Colorado Homeowners Can Postpone Property Tax Payments

If you find yourself in a panic over your property tax bill, a program in Colorado could offer you some much-needed relief. Colorado's Property Tax Deferral Program allows homeowners to delay their property tax payments, potentially for several years, depending on their eligibility. State Treasurer Dave Young emphasized the benefits of the program, stating, "Anytime we can keep folks in their homes and help them find tax relief at the same time is a win for Coloradans." Under this program, homeowners can defer their tax payment for as long as they own their home. However, there is interest charged on the deferred amount, accruing slowly over time. Eligibility for the program has traditionally been focused on seniors and active military personnel. Still, it was expanded last year to assist homeowners affected by increased property taxes between 2020 and 2023. The application deadline is April 1st. Homeowners who aren't seniors or active military can also apply if their property taxes have increased beyond a specified "growth cap." This cap is met when the current year's property tax amount has increased by 4% or more compared to the average of the two preceding tax years. Given the significant spikes in property values observed in various parts of the state, many homeowners are likely to qualify for the program due to substantial increases in their property tax bills. It's important to note that the program does not exempt homeowners from paying taxes altogether. Instead, it functions as a loan that homeowners repay later. Seniors and active military personnel must reapply for deferral each year, while others eligible under the growth cap-based criteria can defer for as long as they own their home, provided the deferred amount does not exceed $10,000. Homeowners are not required to pay any portion of their deferred tax amount, including interest, as long as they continue to reapply annually. The current interest rate for deferrals is 4.125%, meaning the deferred tax amount will increase by this percentage each year. Additional eligibility criteria include owner occupancy of the property, payment of all property taxes before 2024, and non-commercial use of the property. To apply for the program, homeowners can visit colorado.propertytaxdeferral.com or contact 833-634-2513 (toll-free) or [email protected] for assistance. For those seeking information on property tax exemptions for disabled veterans, gold star spouses, or senior citizens, inquiries can be directed to [email protected] or by calling 303-864-7777 or 303-864-7758.

The Importance of Having Your Own Agent Representation When Buying a New Construction Home

The Importance of Having Your Own Agent Representation When Buying a New Construction Home In the world of real estate, the journey to finding your dream home can be both thrilling and daunting, especially when considering the purchase of a new construction property. While it may seem straightforward to work directly with the builder's sales team, having your own agent representation is a crucial step that many buyers overlook. In this blog, we'll delve into why having an agent on your side is invaluable when navigating the purchase of a new construction home. Answer: You NEED representation when working with builders. Why? Advocacy and Protection: One of the primary benefits of having your own agent when buying new construction is having someone solely dedicated to your interests. The builder's sales team represents the builder's interests, aiming to sell homes at the highest possible price and with terms favorable to the builder. Conversely, your agent is there to advocate for you, ensuring that your needs and concerns are addressed throughout the process. They can negotiate on your behalf, review contracts, and provide valuable insights to protect your investment. Expert Guidance: Buying a new construction home involves a unique set of challenges and considerations compared to purchasing an existing property. Your agent brings expertise and experience to the table, guiding you through each stage of the process. From selecting the right floorplan and customizations to understanding the intricacies of new construction contracts and warranties, your agent's knowledge can be invaluable in making informed decisions. Market Insights: While builders may provide information about the neighborhood and surrounding amenities, your agent offers a broader perspective on the local real estate market. They can provide insights into property values, market trends, and future developments that may impact your investment. Armed with this knowledge, you can make a more informed decision about the location and potential resale value of your new construction home. Negotiation Power: Contrary to popular belief, working with your own agent doesn't necessarily increase the cost of purchasing a new construction home. In fact, having representation can sometimes give you leverage in negotiations. Your agent can help negotiate pricing, upgrades, and incentives, potentially saving you money or securing additional perks that you might not have obtained on your own. Smoother Transaction: Buying a new construction home involves coordinating with various parties, including builders, lenders, inspectors, and contractors. Your agent acts as a central point of contact, streamlining communication and ensuring that all aspects of the transaction proceed smoothly. They can also help anticipate and mitigate potential issues, minimizing the risk of delays or complications along the way. Support Beyond the Sale: Even after you've closed on your new construction home, your agent continues to be a valuable resource. Whether you have questions about homeownership, need recommendations for local services, or want to explore future real estate opportunities, your agent is there to provide ongoing support and assistance. While it may be tempting to navigate the purchase of a new construction home alone or solely with the builder's sales team, having your own agent representation offers numerous advantages. From advocacy and expert guidance to market insights and negotiation power, your agent works tirelessly to protect your interests and ensure a successful transaction. So, before embarking on your journey to buy a new construction home, consider enlisting the expertise of a trusted real estate agent to guide you every step of the way. Important Reminders: 1. In most cases, the builder covers your agent's fees, so you're not bearing the cost for added protection. **For this to be true you often MUST advise them on your FIRST visit that you have an agent! Always always tell them you have an agent!** 2. Contracts drafted by builders heavily favor their interests and theirs alone. 3. Remember, the builder's primary concern is their own profit, not your well-being. 4. Any incentives offered by the builder can often be negotiated through your agent. Don't fall for their "special incentives" as they may be used to dissuade you from seeking additional support. 5. Having an agent represents a win-win scenario: you gain an advocate fighting on your behalf, and the builder covers their fees. It's essential to prioritize your protection in the deal.

The Definitive Guide to Interior Design and Fashion Trends of 2024 as Told by Vogue

In the intricate dance between interior design and fashion, 2024 brings a seamless fusion of trends that captivate both worlds. Vogue's insights from top decorators reveal a prevailing theme: "quiet luxury." Inspired by the sophisticated allure of shows like Succession and a retreat from ostentatious luxury, this trend manifests in soft textures, warm woods, and subdued patterns dominating home designs. Brands like Hermès shine, emphasizing timeless, classic pieces over flashy extravagance. What's In: 1. Quiet Luxury: - "Classic, investment pieces" take center stage—pieces that stand the test of time and evolve through reupholstery. (Jake Arnold) - Luxurious, soft fabrics, warm woods, and subtle patterns redefine opulence. (Timothy Corrigan) 2. Mono-Rooms: - Tone-on-tone decor allows for emphasis on texture, silhouette, and material. (Jeremiah Brent) - Single-textile-pattern rooms let furniture shine. (Joy Moyler) 3. Fashion Colors as Home Colors: - Brown emerges as a dominant hue, transitioning from fashion to interiors. (Martyn Lawrence Bullard) - Red, a fashion trend of 2023, spills into home decor. (Joy Moyler) 4. Vintage Lighting: - Vintage lighting adds character and patina to living spaces. (Heidi Caillier) 5. China Pantries: - Modern takes on 'butler pantries' with a retail display quality are in demand. (Joy Moyler) 6. Stripes: - Bold, candy-style stripes make a comeback in both rooms and fashion. (Heidi Caillier) 7. Glass Bricks: - A resurgence of glass bricks as innovative materials for floors, tables, and tiles. (Brigette Romanek) 8. Yellow: - Buttery yellow for millwork and upholstery brings warmth to spaces. (Jake Arnold) - Yellow signifies confidence, merging traditional forms with modern elements. (Robin Standefer) 9. Marble Accessories: - Stone and marble furniture/accessories add personality and uniqueness. (Jenni Kayne) 10. Dark Wood-Paneled Walls: - A revival of dark wood-paneled walls for warmth and modern aesthetics. (Robin Standefer) 11. Local Makers and Design: - A focus on local craft and materials connecting interiors to their surroundings. (Vicky Charles) 12. Mixing Textures: - Experimentation with varied textures like plaster walls mixed with wood floors. (Jenni Kayne) 13. Silver Accents: - Silver takes the lead, blending timeless and versatile qualities. (Robin Standefer) 14. One-of-a-Kind Pieces: - Embracing handmade, one-of-a-kind pieces for a bespoke feel. (Jeremiah Brent) 15. Collectibles: - Curating collections within homes, celebrating the art of the collection. (Martin Brudnizki) 16. Futuristic Materials: - Contemporary fixtures with innovative materials like recycled plastics gain popularity. (Kelly Wearstler) What's Out: 1. Instagram Design: - A departure from replicated designs from Instagram and Pinterest. (Jake Arnold) - A move away from flawless, stage set interiors towards real, lived-in spaces. (Vicky Charles) 2. Ivory Boucle: - A shift away from the ubiquitous use of ivory boucle. (Heidi Caillier) 3. Fast Furniture: - Clients favor investing in quality, enduring pieces with sustainability in mind. (Heidi Caillier) 4. Fake Fur Throws: - Fake fur throws make way for woven textures and knits. (Vicky Charles) 5. Wicker Lamps: - Wicker lighting fixtures fade away from trendiness. (Timothy Corrigan) 6. Ruffles: - Ruffled edges and skirted tables become dated. (Kathryn M. Ireland) 7. Minimalism: - Minimalism loses appeal; layered neutrals make a confident design statement. (Alfredo Paredes) 8. Mid-Century Modern Angular Furniture: - Angular mid-century-looking pieces witness a decline. (Timothy Corrigan) 9. All-White Kitchens: - All-white kitchens give way to vibrant colors and bold choices. (Martyn Lawrence Bullard) 2024 invites a departure from the mundane, celebrating a harmonious blend of timeless luxury, individuality, and a nod to sustainable, enduring design.

2024 Presidential Election and the Denver-Metro Real Estate Market

Will The 2024 Presidential Election Impact Our Housing Market? Real estate is a dynamic interplay of affordability, supply, and the economy. Guess what takes center stage during presidential elections? You got it – the nation's well-being! While history suggests elections typically don't rattle the real estate boat too much, recent times (cue 2020!) threw in some curveballs. Now, there are those buyers who might be a bit jittery about election outcomes, but others are laser-focused on the here and now – assessing if the market aligns with their goals at this very moment. Link up with your local real estate pro – they've got the intel. In the Denver-Metro, we're experiencing a tight supply, surging demand, and buyers making moves early! We're talking multiple offers, increasing home values, and an early start to the spring market. Don't let the fear of economic uncertainty rain on your parade – if it aligns with YOUR goals, it's prime time to buy/sell!

Unraveling the Overpayment Scam: Stay Informed, Stay Protected

In the digital age, where convenience often meets complexity, scams have found new ways to exploit unsuspecting victims. One such deceptive maneuver that has gained notoriety is the overpayment scam. Read about one Denver homeowner's recent experience: here! Understanding the Overpayment Scam: The overpayment scam typically involves a scammer posing as a legitimate entity, often a buyer, employer, or someone offering a service. The scammer contacts the victim, claiming they have overpaid for a product or service due to an error or other unforeseen circumstance. To rectify the alleged overpayment, the victim is then requested to refund the excess amount via a specific method, which is usually a fake check, wire transfer, or an online payment platform. How It Works: Contact Initiation: The scam starts with an unsolicited contact, often via email, phone call, or messaging, from someone posing as a buyer, employer, or service provider. Claim of Overpayment: The scammer alleges that they have overpaid for a product or service, providing a seemingly plausible reason for the error. Refund Request: To rectify the overpayment, the victim is asked to refund the excess amount using a specified payment method, which is usually one that is difficult to trace. Fake Payments: The victim receives a fraudulent check or payment, which may initially appear legitimate. Believing they are acting in good faith, the victim refunds the alleged overpayment. Unraveling the Scam: Eventually, the victim discovers that the initial payment was fake, leaving them out of pocket for the refunded amount. Red Flags to Watch Out For: Unsolicited Contacts: Be wary of unexpected communications, especially if they involve financial transactions or overpayments. Pressure Tactics: Scammers often create a sense of urgency, pressuring victims to act quickly without thorough consideration. Overly Generous Offers: If an offer seems too good to be true, it probably is. Be skeptical of situations where you are asked to refund overpayments. Unusual Payment Methods: Fraudsters often request payment through unconventional or untraceable methods. Protecting Yourself: Verify Contacts: Verify the legitimacy of the person or entity contacting you. Cross-reference contact details and be cautious of inconsistencies. Independently Verify Payments: Independently verify the legitimacy of any payment received before initiating any refunds. Secure Payment Channels: Use secure and traceable payment methods for transactions. Avoid wire transfers or unconventional payment platforms. Educate Yourself: Stay informed about common scams and be vigilant. Awareness is a powerful tool in protecting yourself from potential threats. As technology evolves, so do the tactics of scammers. The overpayment scam is a poignant example of how deception can take various forms. By staying informed, exercising caution, and verifying details independently, you can fortify yourself against falling victim to such schemes. Remember, vigilance is the key to staying one step ahead of those who seek to exploit trust and goodwill. Stay informed, stay protected. Looking for contractor suggestions? Reach out! I've got a list of trustworthy, vetted contractors ready to connect you with the right one!

Gray is OUT - Embrace the Diverse Colors of 2024